The financial technology sector, commonly referred to as fintech, has emerged as a transformative force within the global economy. Over the past decade, fintech has revolutionized how individuals and businesses manage their finances, access banking services, and engage in transactions.

As smartphones and internet connectivity have become ubiquitous, consumers have come to expect seamless digital experiences in all aspects of their lives, including finance. This shift has paved the way for innovative solutions that challenge traditional financial institutions. Fintech encompasses a wide range of services, from mobile payment platforms and peer-to-peer lending to robo-advisors and blockchain technology.

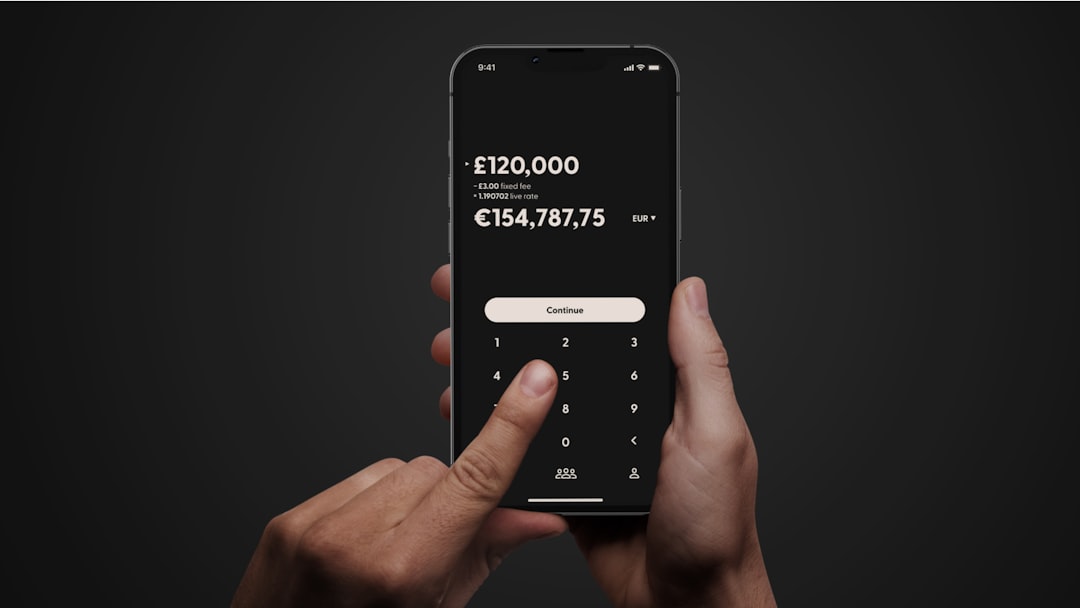

Companies like PayPal, Square, and Stripe have redefined payment processing, making it easier for businesses to accept payments online and for consumers to make purchases with just a few taps on their smartphones.

This democratization of finance has not only empowered consumers but has also led to increased competition among financial service providers, driving innovation and improving service quality across the board.

Key Takeaways

- Fintech is revolutionizing the finance industry by offering innovative solutions and services through technology.

- Traditional banking systems are being disrupted by Fintech, leading to increased competition and improved customer experience.

- Artificial Intelligence and Machine Learning play a crucial role in Fintech by enabling personalized financial services and risk assessment.

- Fintech is transforming personal finance management by providing convenient and accessible tools for budgeting, investing, and saving.

- The future of Fintech lies in blockchain and cryptocurrency, offering secure and decentralized financial transactions.

How Fintech is Disrupting Traditional Banking Systems

Breaking Down Barriers

Historically, banks have controlled access to credit, savings accounts, and investment opportunities, acting as gatekeepers of financial services. However, fintech companies have introduced alternative models that bypass these traditional barriers, providing consumers with more options and greater flexibility.

Peer-to-Peer Lending and Digital Banking

Platforms like LendingClub and Prosper have enabled individuals to lend money directly to one another, cutting out the need for banks as intermediaries. This shift has resulted in potentially lower interest rates for borrowers and higher returns for investors compared to traditional savings accounts. Digital banks such as Chime and N26 have also streamlined account opening processes, allowing customers to complete applications in minutes through mobile apps, unlike traditional banks that require lengthy paperwork and in-person visits.

A Shift Toward Customer-Centric Services

The fintech industry’s focus on technology and innovation has led to a level of transparency and efficiency that traditional banks often struggle to match. This shift towards digital-first banking is not just about convenience; it reflects a broader trend toward customer-centric services that prioritize user experience over legacy systems.

The Role of Artificial Intelligence and Machine Learning in Fintech

Artificial intelligence (AI) and machine learning (ML) are at the forefront of fintech innovation, driving advancements that enhance decision-making processes and improve customer experiences. These technologies enable fintech companies to analyze vast amounts of data quickly and accurately, allowing them to identify patterns and trends that inform their services. For instance, AI algorithms can assess creditworthiness by analyzing non-traditional data sources such as social media activity or transaction history, providing a more comprehensive view of an individual’s financial behavior.

This approach can help expand access to credit for underserved populations who may not have a traditional credit history. Additionally, AI-powered chatbots are transforming customer service within the fintech space. Companies like Kasisto and Cleo utilize natural language processing to create virtual assistants that can answer customer inquiries, provide financial advice, and even facilitate transactions.

This not only reduces operational costs for fintech firms but also enhances customer satisfaction by providing instant support around the clock. As AI continues to evolve, its applications in fraud detection and risk management are becoming increasingly sophisticated. Machine learning models can analyze transaction patterns in real-time to flag suspicious activities, thereby reducing the risk of fraud and enhancing security for users.

Fintech’s Impact on Personal Finance Management

| Metrics | Impact |

|---|---|

| Increased Access | Allows individuals to easily access and manage their finances through digital platforms. |

| Automation | Automates financial tasks such as budgeting, saving, and investing, making it more efficient. |

| Personalized Recommendations | Provides personalized financial advice and recommendations based on individual’s spending habits and goals. |

| Cost Reduction | Reduces the cost of financial services and transactions compared to traditional banking. |

| Security | Offers advanced security measures to protect personal financial information and transactions. |

Fintech has significantly altered how individuals manage their personal finances by providing tools that promote better financial literacy and decision-making. Applications like Mint and YNAB (You Need A Budget) empower users to track their spending habits, set budgets, and achieve savings goals through intuitive interfaces and personalized insights. These platforms often utilize gamification techniques to encourage users to engage with their finances actively, making the process of budgeting less daunting and more rewarding.

Moreover, fintech solutions are increasingly integrating features that promote holistic financial wellness. For example, some apps offer investment options alongside budgeting tools, allowing users to allocate funds toward savings or investments seamlessly. This integration fosters a more comprehensive approach to personal finance management, encouraging users to think beyond mere spending and saving toward long-term financial health.

As consumers become more aware of their financial situations through these tools, they are better equipped to make informed decisions about their money.

The Future of Fintech: Blockchain and Cryptocurrency

As fintech continues to evolve, blockchain technology and cryptocurrency are poised to play pivotal roles in shaping its future landscape. Blockchain offers a decentralized ledger system that enhances transparency and security in transactions. This technology has the potential to disrupt various sectors beyond finance, including supply chain management and healthcare.

In the context of fintech, blockchain can facilitate faster cross-border payments by eliminating intermediaries and reducing transaction costs significantly. Cryptocurrencies like Bitcoin and Ethereum have gained traction as alternative forms of currency and investment vehicles. The rise of decentralized finance (DeFi) platforms exemplifies this trend, allowing users to lend, borrow, and trade assets without relying on traditional financial institutions.

DeFi protocols leverage smart contracts on blockchain networks to automate transactions and enforce agreements transparently. As regulatory frameworks around cryptocurrencies continue to develop, the potential for mainstream adoption grows, further integrating these digital assets into everyday financial activities.

Fintech and the Small Business Revolution

Fintech is also driving a revolution in small business financing by providing innovative solutions tailored to the unique needs of entrepreneurs. Traditional banks often impose stringent requirements for loans that can be prohibitive for small businesses or startups lacking established credit histories. In contrast, fintech lenders like Kabbage and OnDeck offer alternative financing options that consider factors such as cash flow and business performance rather than solely relying on credit scores.

Additionally, fintech solutions are streamlining payment processing for small businesses through platforms like Square and PayPal. These services enable merchants to accept payments via mobile devices or online without the need for expensive point-of-sale systems or lengthy contracts with banks. This accessibility empowers small business owners to focus on growth rather than getting bogged down by administrative tasks related to payment processing or financing.

Regulatory Challenges and Opportunities in Fintech

While the rapid growth of fintech presents numerous opportunities for innovation and improved financial services, it also raises significant regulatory challenges. Governments around the world are grappling with how to regulate this fast-evolving sector without stifling innovation. The lack of a unified regulatory framework can create uncertainty for fintech companies seeking to operate across borders or expand their services internationally.

Regulatory bodies are increasingly recognizing the need for balanced approaches that foster innovation while ensuring consumer protection and financial stability. Initiatives such as regulatory sandboxes allow fintech startups to test their products in controlled environments under regulatory oversight. This approach enables regulators to understand emerging technologies better while providing startups with the flexibility to innovate without facing immediate compliance burdens.

The Social Impact of Fintech: Financial Inclusion and Accessibility

One of the most profound impacts of fintech is its potential to enhance financial inclusion and accessibility for underserved populations worldwide. Traditional banking systems often exclude individuals without access to physical bank branches or those lacking sufficient credit histories. Fintech solutions address these barriers by offering services through mobile devices that can reach remote areas or marginalized communities.

For instance, mobile money platforms like M-Pesa in Kenya have transformed how people conduct transactions in regions where banking infrastructure is limited. By allowing users to send money via SMS or mobile apps, M-Pesa has enabled millions of individuals to participate in the formal economy for the first time. This increased access not only empowers individuals but also stimulates local economies by facilitating commerce and enabling savings.

Furthermore, fintech’s emphasis on user-friendly interfaces and personalized services caters to diverse demographics, including younger generations who prefer digital interactions over traditional banking methods. As fintech continues to evolve, its commitment to inclusivity will be crucial in bridging the gap between those who have access to financial services and those who do not, ultimately fostering a more equitable financial landscape for all.

If you are interested in the intersection of technology and finance, you may also want to check out this article on Understanding Math & AI: A Comprehensive Guide. This article delves into the role of mathematics and artificial intelligence in shaping various industries, including fintech. It provides a comprehensive overview of how these two fields are revolutionizing the way we approach problem-solving and decision-making in the digital age.

+ There are no comments

Add yours