Financial planning is a comprehensive approach to managing one’s financial resources to achieve specific life goals. It encompasses a wide array of activities, including budgeting, saving, investing, and risk management. At its core, financial planning is about making informed decisions that align with an individual’s or family’s financial objectives.

This process begins with a thorough assessment of one’s current financial situation, which includes evaluating income, expenses, assets, and liabilities. By understanding where one stands financially, it becomes easier to identify areas for improvement and set realistic goals. Moreover, financial planning is not a one-time event but rather an ongoing process that requires regular review and adjustment.

Life circumstances can change due to various factors such as job changes, family dynamics, or economic shifts. Therefore, a solid financial plan should be flexible enough to adapt to these changes while remaining focused on long-term objectives. The importance of financial literacy cannot be overstated in this context; individuals must educate themselves about financial concepts and tools to make sound decisions.

This foundational knowledge empowers them to navigate the complexities of personal finance effectively.

Key Takeaways

- Financial planning involves understanding your current financial situation, setting goals, and creating a plan to achieve those goals.

- Setting financial goals and creating a budget are essential steps in managing your finances and working towards financial stability.

- Managing debt and building an emergency fund are important for financial security and stability in the event of unexpected expenses.

- Investing for the future, including retirement, education, and wealth building, is crucial for long-term financial success.

- Protecting your assets through insurance and estate planning helps safeguard your financial well-being and provide for your loved ones in the future.

- Revisiting and adjusting your financial plan regularly is important to ensure it continues to align with your goals and financial situation.

Setting Financial Goals and Creating a Budget

Establishing SMART Financial Goals

The SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—can be an effective framework for establishing these goals. For instance, instead of vaguely stating that one wants to save money, a more specific goal would be to save $5,000 for a family vacation within the next 12 months. This clarity not only provides direction but also serves as motivation to stay on track.

Creating a Budget to Achieve Financial Goals

Once financial goals are established, creating a budget becomes essential. A budget acts as a roadmap for managing income and expenses, ensuring that individuals allocate their resources effectively toward their goals. The budgeting process typically involves tracking all sources of income and categorizing expenses into fixed (like rent or mortgage payments) and variable (such as dining out or entertainment).

Tracking Progress and Making Adjustments

By analyzing spending patterns, individuals can identify areas where they can cut back and redirect those funds toward their savings or debt repayment efforts. Tools such as budgeting apps or spreadsheets can facilitate this process, making it easier to monitor progress and adjust as necessary.

Managing Debt and Building an Emergency Fund

Debt management is a crucial aspect of financial planning that can significantly impact an individual’s overall financial health. High-interest debt, such as credit card balances, can quickly spiral out of control if not addressed promptly. One effective strategy for managing debt is the snowball method, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts.

This approach not only reduces the number of creditors but also provides psychological benefits as individuals experience quick wins. Alternatively, the avalanche method prioritizes debts with the highest interest rates first, ultimately saving money on interest payments over time. In tandem with debt management, building an emergency fund is vital for financial stability.

An emergency fund serves as a financial safety net that can cover unexpected expenses such as medical emergencies or car repairs without resorting to high-interest debt. Financial experts often recommend saving three to six months’ worth of living expenses in this fund. To build this reserve, individuals can start by setting aside a small percentage of their income each month until they reach their target amount.

Automating these savings through direct deposits into a separate savings account can help ensure consistency and make it easier to reach this important milestone.

Investing for the Future: Retirement, Education, and Wealth Building

| Category | Retirement | Education | Wealth Building |

|---|---|---|---|

| Investment Options | 401(k), IRA, Annuities | 529 Plan, Education Savings Account | Stocks, Bonds, Real Estate |

| Time Horizon | Long-term (30+ years) | Medium-term (5-18 years) | Long-term (10+ years) |

| Risk Tolerance | Low to Moderate | Moderate | Moderate to High |

| Expected Return | 6-8% | 5-7% | 7-10% |

Investing is a key component of financial planning that allows individuals to grow their wealth over time. The earlier one starts investing, the more time their money has to compound. Retirement accounts such as 401(k)s and IRAs offer tax advantages that can significantly enhance long-term savings.

For example, contributions to a traditional IRA may be tax-deductible, while Roth IRAs allow for tax-free withdrawals in retirement. Understanding the different types of investment accounts and their respective benefits is crucial for effective retirement planning. In addition to retirement savings, many families prioritize education funding for their children.

529 plans are popular vehicles for this purpose, offering tax-free growth when used for qualified education expenses.

Furthermore, investing in diversified portfolios that include stocks, bonds, and mutual funds can provide growth opportunities while managing risk.

A well-thought-out investment strategy should align with one’s risk tolerance and time horizon, ensuring that individuals are comfortable with their investment choices.

Protecting Your Assets: Insurance and Estate Planning

Protecting one’s assets through insurance is an essential aspect of comprehensive financial planning. Various types of insurance—such as health, auto, home, and life insurance—serve to mitigate risks that could otherwise lead to significant financial loss. For instance, health insurance protects against exorbitant medical costs that could deplete savings or lead to debt.

Similarly, life insurance provides financial security for dependents in the event of an untimely death. Evaluating insurance needs regularly ensures that coverage remains adequate as life circumstances change. Estate planning is another critical component of asset protection that often gets overlooked.

It involves preparing for the distribution of one’s assets after death and can include creating wills, trusts, and powers of attorney. A well-structured estate plan ensures that assets are distributed according to one’s wishes while minimizing tax implications for heirs. For example, establishing a trust can help avoid probate—a lengthy legal process that can delay asset distribution and incur additional costs.

Engaging with legal professionals who specialize in estate planning can provide valuable insights into creating a plan that aligns with individual goals and family dynamics.

Revisiting and Adjusting Your Financial Plan

Financial planning is not static; it requires regular review and adjustment to remain effective in achieving one’s goals. Life events such as marriage, divorce, job changes, or the birth of a child can significantly impact financial circumstances and priorities. Therefore, it is advisable to revisit the financial plan at least annually or whenever significant life changes occur.

This review process involves assessing progress toward goals, evaluating current investments, and adjusting budgets as necessary.

For instance, shifts in interest rates may affect borrowing costs or investment returns, prompting individuals to reconsider their debt management strategies or investment allocations.

By maintaining flexibility and being proactive in adjusting their financial plans, individuals can better navigate uncertainties and stay aligned with their long-term objectives. Engaging with financial advisors or utilizing financial planning software can also provide valuable support in this ongoing process of refinement and adaptation.

If you are interested in exploring the intersection of philosophy and technology, you may want to check out this article on analytic philosophy and its rigorous approach to philosophical inquiry. This article delves into how analytic philosophy can provide a structured framework for examining complex philosophical questions, much like how adding a watermark to a PDF document can enhance its security and authenticity. Both processes involve a methodical approach to uncovering deeper meanings and protecting valuable information.

FAQs

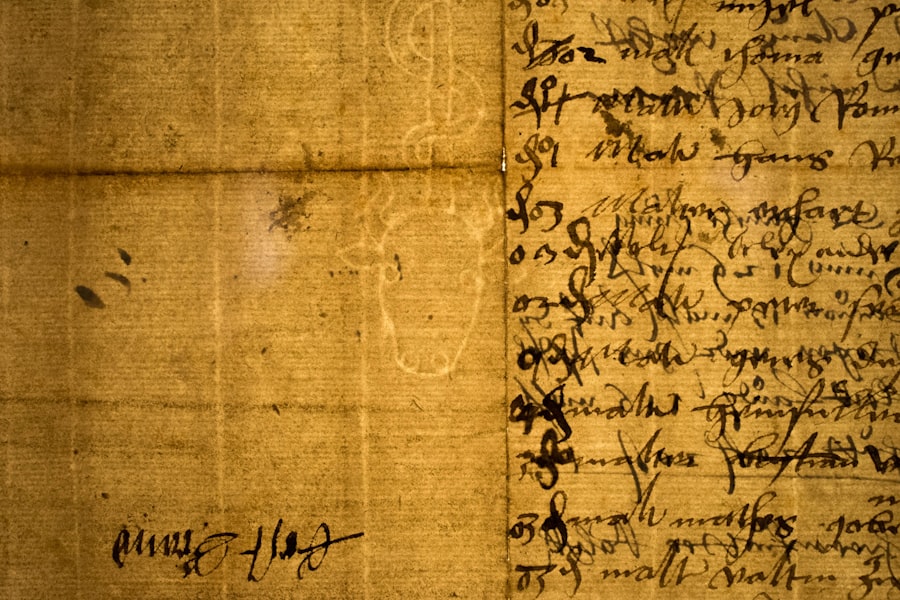

What is a PDF watermark?

A PDF watermark is a recognizable image or text that is added to a PDF document to indicate its ownership, status, or confidentiality. It is often used to protect the document from unauthorized use or distribution.

How can I add a watermark to a PDF?

You can add a watermark to a PDF using various software or online tools specifically designed for PDF editing. These tools allow you to insert text or image watermarks, adjust their appearance, and position them within the document.

What are the benefits of using a PDF watermark?

Using a PDF watermark can help protect your documents from unauthorized use, deter plagiarism, and enhance the professional appearance of the document. It can also help to establish ownership and indicate the document’s status or confidentiality.

Can I remove a PDF watermark?

In most cases, a PDF watermark can be removed using PDF editing software or online tools. However, it is important to note that removing a watermark without permission may infringe on the owner’s rights and could lead to legal consequences.

Are there any legal considerations when using a PDF watermark?

The use of a PDF watermark should comply with copyright laws and regulations. It is important to ensure that you have the right to add a watermark to a document, especially if it contains copyrighted material. Additionally, removing someone else’s watermark without permission may constitute copyright infringement.

+ There are no comments

Add yours